Social Security Tax Limit 2024 Increase Upsc. For 2024, that maximum is set at. The social security tax limit is set each year.

The wage base or earnings limit for the 6.2% social security tax rises every year. The limit for 2023 and 2024 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

Social Security Tax Limit 2024 Increase Upsc Images References :

Source: rachelewlira.pages.dev

Source: rachelewlira.pages.dev

Social Security Tax Limit 2024 Increase Deanne Sandra, In 2025, this increase might be a bit.

Source: rachelewlira.pages.dev

Source: rachelewlira.pages.dev

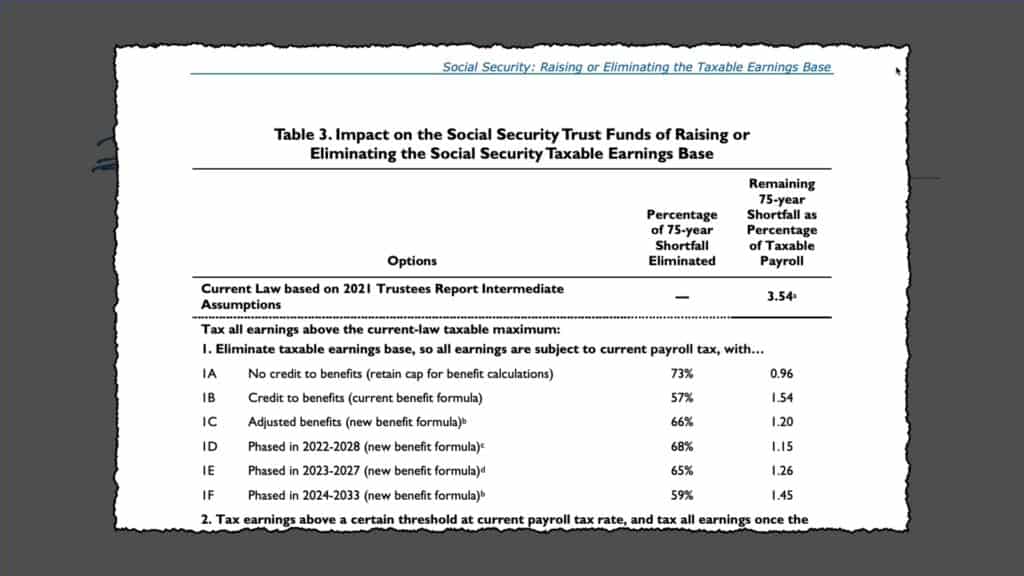

Social Security Tax Limit 2024 Increase Deanne Sandra, Earnings above that level are not taxed for the.

Source: ravenqmillie.pages.dev

Source: ravenqmillie.pages.dev

What Is The Social Security Tax Limit 2024 Fanny Jehanna, (for 2023, the tax limit was $160,200.

Source: judyysibylle.pages.dev

Source: judyysibylle.pages.dev

Social Security Limit 2024 Tax Rate Rorie Claresta, (for 2023, the tax limit was $160,200.

Source: keeliawalysa.pages.dev

Source: keeliawalysa.pages.dev

Social Security Tax Maximum 2024 Nanni Jacquelin, For 2024, the social security tax limit is $168,600 (up from $160,200 in 2023).

Source: dawnaymichel.pages.dev

Source: dawnaymichel.pages.dev

Maximum Social Security Tax In 2024 Golda Kandace, For 2024, the social security tax limit is $168,600.

Source: marlenawdarda.pages.dev

Source: marlenawdarda.pages.dev

Social Security Maximum Tax Withholding 2024 Erinn Jacklyn, That means that the maximum amount of social security tax an employee will pay (through withholding from their.

Source: matricbseb.com

Source: matricbseb.com

Social Security Tax Limit 2024 All You Need to Know About Tax Limit, For 2024, that maximum is set at.

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png) Source: narikowcarie.pages.dev

Source: narikowcarie.pages.dev

Social Security Limit 2024 Irs Ree Lenora, So, if you earned more than $160,200 this last year, you didn't have to pay the social security.

Source: linzyqandreana.pages.dev

Source: linzyqandreana.pages.dev

Social Security Tax Limit 2024 Increase Kikelia, In 2023, the limit was $160,200.